A deep-dive into OTC Market Group’s (OTCM) business that covers its business model, KPIs, competitive analysis, risks, financials, management quality and valuations.

What does OTC Markets Group do?

OTC market group runs three tiers of OTC (over the counter) market in the US for the domestic & international companies who want to raise capital and issue their stocks & bonds but don’t want to deal with high costs and compliance requirements needed to get listed on national stock exchanges like NYSE and NASDAQ. The tiers of markets ran by OTC market groups are:

– OTCQX: To be listed in this market, companies need to disclose their financials, undergo detailed financial review by OTC Market group, require 3rd party sponsor and satisfy many other legal & financial requirements. This is one of the most liquid OTC markets in the US. This market mainly serves established domestic and international businesses who don’t see a need to or want to spend a lot of resources on getting listed on national stock exchanges but still want to raise capital and have liquidity. As of 2023, over 650 securities were traded on QTCQX. It has a retention rate of around 95%.

-OTCQB Venture Market: This market is mainly targeted towards development stage companies. It allows penny stocks (unlike OTCQX) but requires the companies to undergo review by OTC Markets Group and need annual OTCQB certification. As of 2023, over 1200 securities were traded on OTCQB. It has a retention rate of around 90%.

– Pink Market: This market has the least compliance and reporting requirements for the companies. This market often includes shell companies, companies with limited operating histories, companies going through financial distress or bankruptcy. As of 2023, over 10K companies were traded on the Pink Market.

How does OTC Market Group make money?

OTC Market Group makes money through its 3 different business lines:

1. OTC Link: It provides 3 alternative trading systems (one for each of their markets) and related tools for registered broker-dealers, market makers and other participants to trade equity securities. It charges a fixed annual or quarterly fee to the participants for the right to trade and also charges a commission for transactions made on trades depending on trade volumes. This business accounts for around 20% of their revenue.

2. Market Data Licensing: OTC Markets Group generates a significant amount of trading & associated data due to operating 3 different markets and their ATSs. They package this data into various forms and sell these data products to various stakeholders like financial service providers, exchanges, brokerages, data distributors (like Bloomberg), etc. These are sold in the form of subscriptions and therefore have less variability and dependency on the trading volumes. This business line contributes around 35% to their revenues.

3. Corporate Services: This business includes the operation of 3 of their OTC markets – OTCQX, OTXQB and Pink Sheets. OTC Market groups charge qualifying companies one-time listing fees and then annual renewal fees to remain listed on the markets. It also provides “Disclosure & News Service” through which listed companies can publish disclosures, hold investor conferences etc. This business contributes around 45% to their revenue.

As of 2023, over 80% of their revenue were recurring in nature through subscriptions and less than 20% were from one-time/non-recurring sources.

What are OTC Market Group’s KPIs?

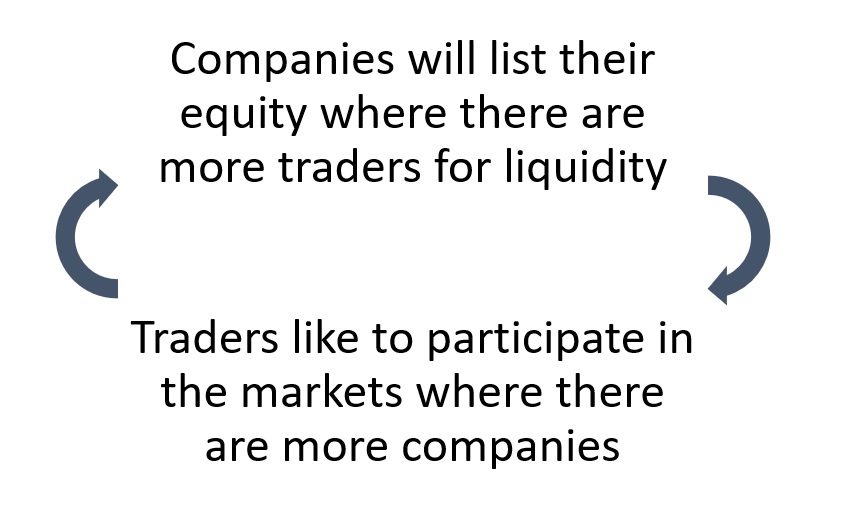

To understand what are the key performing factors of OTC Market group’s , we should look at how synergetic and self-feeding their business:

This loop-effect over time compounds over time results in more numbers of companies listed, more participants, more data, more stakeholders. Therefore the most important KPI for OTC Market Groups are:

– Number of listed Companies

– Number of market participants (broker-dealers/traders)

– Long term Dollar volume traded (avoid year on year variation and look at long term trend)

In the last 10 years, number of listed securities have grown from 9974 to 12589, Number of market participants have grown from less than 120 to 189 and dollar volume traded has grown from $135B to over $507B. And due to these KPIs improving and new data products offered, its revenue in the same time-period, grew from $30M to $96M and earnings grew from 4.8M to $30M

Competitive Analysis & Moat:

Barrier to Entry: OTC Market Groups runs a marketplace business where it brings different stakeholders together and enables them by providing needed tools & services. It operates in a “winner takes all” environment. Therefore, it has the majority market share(almost 100% in the OTC business). Also due to SEC rules, national stock exchanges like NYSE & NASDAQ cannot run a market place for non-sec registered companies. All this creates a huge barrier to enter for new players.

Buyer Power: Due to being one of its kind business in the US, it is sort of an only option for companies who want to be listed in the US but don’t want to bear the listing & compliance of NYSE & NASDAQ. This provides OTC Market Groups good pricing power in its Corporate Service Business. However on the market data side of the business there are many big redistributors like Bloomberg and that snips the potential revenue. Overall due to the unique offering OTC Market groups commands healthy pricing power and therefore over the years it has been able to increase prices sustainably.

Supplier Power: OTC Market groups depend on high quality external developers & technicians to develop the required tools, services and associated logistics for proper functioning of all 3 markets. It also depends on many key-employees to maintain healthy relationships with listed companies and potential clients. And finally it is highly sensitive to rules & regulations imposed by FINRA & SEC. Any extreme changes in the rules can take away its current competitive advantage.

Substitutes & Competition:

Even though OTC Market groups has no direct competition in the OTC space in the US, it does face a lot of competition from the Private Equity & National Stock Exchanges. In the last decade the market share of Private Equity has increased quite a bit and companies can decide to raise money through private funding instead of listing it on OTC if they don’t need liquidity. Especially in times of high interest environments, companies choose not to IPO due to limited upside.

And on the other hand, currently listed companies can grow in size and can decide to upgrade to National Stock Exchanges for better liquidity and validity from the markets. For example – in 2022, 72 companies de-listed from the OTC market to list themselves on the national stock exchanges.

Overall Moat : Even though it is capped on the upside in terms of pricing power by national stock exchanges, OTC Markets Group enjoys a wide & deep mode in the OTC space. Companies that want to get listed publicly at a lower cost and less regulations do-not have any other alternative in the US. And the moat is clearly validated by its high ROIC , great margins, low capex requirement and therefore high FCF (more on it in the Financials section below).

Financials

Financials of this company are quite simple and easy to understand. Currently around 80% of its revenue comes from subscriptions and that is recurring in nature. And the remaining 20% comes from trading commissions and one time registration and other compliance fees.

As the cost of operations are not high and mainly fixed, this company enjoys very good operating leverage and enjoys margin expansion with an increasing number of clients. In the last 10 years, the company’s revenue grew from 30M to 96M at the rate of ~12% annualized. But at the same time earnings grew from ~$4.8M to ~30M at the rate of 20.11%.

Management

Management Ownership: The CEO owns over 27% of the company and therefore has immense skin-in-the game.

Capital Allocation Strategy: Management has been quite conservative (that’s a good thing) with their capital allocations strategy. The company has no long term debt, ROIC has been over 60% in the last 10 years, pays regular quarterly dividend, often pays high special dividend and has not diluted outstanding stocks by much while maintaining a healthy amount of net-cash balance.

Communication: In OTC market companies have lower bar to meet when it comes to providing accurate & timely information to its stakeholders. However, to the contrary, management has been very transparent & honest about their business prospects. Their annual reports, especially the MDA section of it, has been one of the most simple to understand and still very informative. (I highly encourage you to read their annual report – Click Here

Overall, management seems to be honest, long term focused, conservation and has a lot of skin in the game.

Valuation

As of Jan 2024, the company has a market cap of $700M at the P/E multiple of 23.4.

And using DCF model, with the following conservative assumptions

– 9% annual revenue growth due to the base effect, cyclicity in trading volumes, risk of recession in the coming decade.

– 35% operating margin assuming increasing personnel & technology costs.

– ROE of 55% , compared to over 63% in the last decade

– 10% cost of capital

– 6% terminal rate of return at the end of 10 year period (I have used a higher terminal rate of return because I am using a 10 year model and with such deep moat I believe it will enjoy some growth over the market’s rate of growth)

the intrinsic value of the OTC Market Groups comes out to be around $890M. So that offers a margin of safety of around 22%. (lower than my desired margin of safety of over 50% to give enough room for faults in my analysis & assumptions).

Conclusion

OTC Markets Group operates an extremely differentiated business in a moderate growth industry. It enjoys a deep moat due to unique positioning, operating leverage, strong management and participation in the US market desired by international companies. And because of its subscription nature of revenue (mostly) & lack of alternatives for companies, the predictability and longevity of its business performance is quite high. Also the management has been very prudent by staying conservative, long term focused & investor oriented. Management over time has also been very selective about allocating capital & efficient when it comes to acquisitions.

On the other hand there are a few risks to watch out for. Undesired policy & regulation changes by the SEC can disrupt this company’s moat by allowing other participants to enter. A major national or global recession reduces trading activities, increases bankruptcies and reduces IPOs & new listings which can drastically affect the companies revenue in the long term. Also reduction in fees from National Stock Exchange can also result in more companies leaving the OCT market to join those exchanges. It’s stock is also quite illiquid because it trades on OTC market and over 30% of it is owned by the management for the long term.

Overall it appears to be a unique & boring business that is managed quite well. However due to its illiquidity, not enough margin of safety and moderate growth opportunity it might not be a great investment at this price. A negative catalyst event may create a good entry point in the future.

Disclaimer: This is obviously not investment advice (no equity report on this site is). This post is just to share my learnings and observations. If you want to get better at investing, you should do your own research.

Subscribe if you want to be notified when the next post is published.

Option 1: If you are an email person, subscribe using your email – Click Here

Option 2: If you want get notified on whatsapp without sharing any personal details including your phone number, join my whatsapp channel – Click Here

Watchlist of list that I plan to research & share my learnings: Click Here

One thought on “Analysis of “OTC Markets Group” : Longevity, low Capex and more”