Source: Unsplash

What is EPAM?

A shallow 1st look says EPAM is a mid-size, one of many IT service companies that provides consulting & technology outsourcing services to enterprises across various industries.

However, A deeper second look says that EPAM is different than most of its peers. It differentiates itself by providing efficient solutions using its deep technical expertise for complex technical problems at a much lower cost.

If you are a resident of a western country and have been a customer of Sephora, YouTube, Southwest, Hotels.com & Procter & Gamble then you have used technology implemented by EPAM. EPAM currently serves 100s of such customers across the globe.

Now that you know what EPAM does, lets see how it does it so successfully.

How does it develop & provide services?

Over 20+ years EPAM has developed internal software & digital tools, frameworks & systems that can be scaled, customized & implemented to solve customer problems across various industries.

It has also developed & grown highly skilled technology teams to come up with and implement these solutions.

How does EPAM get paid ?

EPAM has mainly two types of contracts:

1. Time & Material: In this type of deals, EPAM charges for the amount of time EPAM’s employees have worked on implementing solution for the customer and also if any materials (tools, subscriptions, licenses, etc.) were needed to implement the solution. Majority of EPAM’s revenue (more than 80 percent) comes from such deals.

2. Fixed contract: In this type of deals, Customer defines a fixed service required in the defined time and pays a fixed amount to EPAM to provide the service. Minority of EPAM’s revenue (less than 20 percent) comes from such deals.

What inputs do EPAM need?

EPAM, like all other technology companies, needs hardware, software tools, cloud infrastructure, etc. to perform its day to day duties. However the single most important resource for EPAM are its employees.

EPAM needs highly skilled individuals at low cost. And EPAM so far has smartly managed it.

EPAM’s employee attrition rate has been lower than 14% in the past 5 years. Very low compared to 20+ attrition rate in other big IT services companies like Accenture, TCS, Capgemini, etc.

Up until 2021, EPAM mainly hired from Ukraine, Belarus, Russia & other Eastern European Companies. It also had smaller presence in India & Latin American countries. This allowed EPAM to hire, train & retain highly skilled technical individuals at a much lower cost. Ukraine was EPAM’s biggest delivery center.

However, after Russian invasion of Ukraine, EPAM has moved many of its employees from the affected areas and also started hiring more in Asia & Latin America. This has resulted in increase employment related costs.

What is the potential market size?

Note: The goal here is not accuracy but rational approximation of the market size. We want to see if the company has enough room to grow or not.

Simply put, the potential market size is HUGE!!! But that won’t convince you, so here are the details:

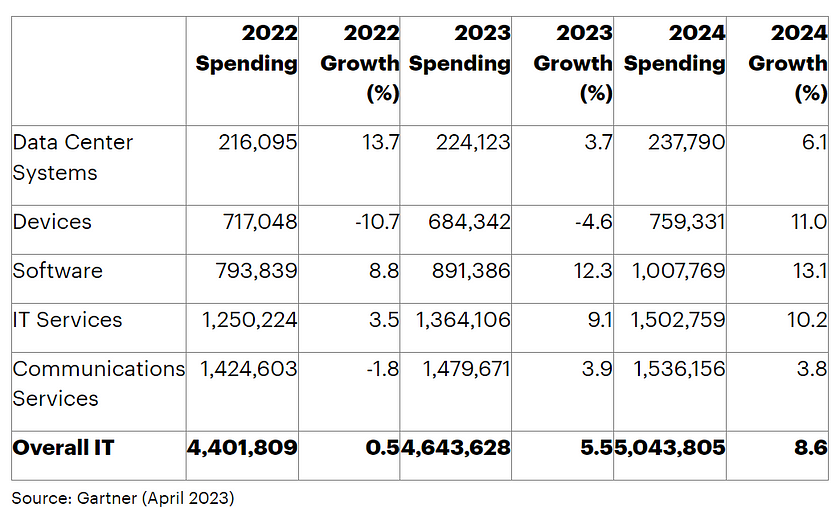

Worldwide IT Spending Forecast (Millions of U.S. Dollars)

So for year 2023, the global IT spending is expected to be around $4.6 Trillion.

And currently, EPAM’s revenue is ~4.8B. So theoretically, EPAM has a huge runway ahead of it. In short, there is no demand shortage in the long term.

However, due to the ongoing war & recession fears, enterprises have started cutting back or pushing out on IT spending (at least for time being). Therefore, 2023 is expected to be bumpy for EPAM (more on it down below). But in the long run, the TAM for EPAM is like a as much as you can eat buffet.

Are there any substitute services to the services that EPAM or other IT services company offers?

Note: Substitute doesn’t mean same product offered by its competitor. It means if there is another product altogether that solves customer need. Example — Crayons can substitute oil color & solve the customer need of coloring.

In today’s day and age, there are only two substitute to services provided by EPAM (& other IT service companies):

1. Customer company decides to do it themselves: This is possible but very costly for most of the companies as they will have to start from scratch and build ground up.

2. Not do anything: This is the costliest option in the long run. Can you imagine what would happen to business who do not go digital. Can you imagine a bank today without a website or an app? or what would happen to a brokerage firm if they do not have a web portal or trading app? They simply would not survive.

Both these options are too costly for most of the companies and therefore, there are not strong substitute to technology services.

Who are the EPAM’s main competitors?

There are many. Accenture, TCS, Infosys, Capgemini and the list goes on. However, as we saw above, the potential size is so huge, that there is enough business for all these companies (as long as they execute well).

What are the main KPIs to focus on?

Revenue per employee —

This shows how efficiently the company enables and uses its resources. It also shows how effective are company’s work framework.

Recurring Revenue(how much revenue is contributed by repeat customers) —

This not only indicates customer satisfaction but also increases potential of revenue growth. It is relatively easier to get more business from an existing customer then to find a new customer.

Employee utilization rate —

This indicator, as the name implies, shows how much of an employees time is paid by the customer. Higher number means that existing employees are utilized efficiently but can also indicate potential issue with allocating resource to new work.

Voluntary attrition rate —

This indicator helps us understand how satisfied are the employees of the company with their work and compensation, potential future costs the company will have to incur for hiring, training and retention. Lower voluntary attrition rate is better.

Now that you know what indicators to look at to understand the health of an IT Service company, lets analyze EPAM’s KPI & compare with other major players as of 2022:

EPAM’s Revenue per Employee = ~$90000. Much higher than Revenue per Employee of Accenture, Infosys, TCS and Capgemini)

EPAM’s Recurring Revenue= ~90%

Employee Utilization Rate = ~75% . This is lower than major competitors. Generally it is above 80%,but due to Russia’s invasion of Ukraine many of the employees were under utilized. Basically the employee costs remained flat or increased but the revenue they brought in declined.

Voluntary Attrition Rate = ~13% . Generally the voluntary attrition rate in an IT service company is very high. Most of the companies see this around 20%. But EPAM even during the invasion of Ukraine is able to maintain a lower attrition rate than others in the industry. This results in less cost of hiring & training new employees and also helps with continuity of work. This is one of EPAM’s secret super power that the market generally doesn’t recognize.

How does EPAM differentiate itself? What is EPAM’s moat (if any)?

EPAM seems to do many small things right and thereby create a wide moat. EPAM is known for:

– High quality service deployment — Customer Satisfaction

– Broad technical skills that allow them to build & support from start to end (a one stop shop for customer) — Customer Satisfaction

– Low attrition rate compared to peers — Employee Satisfaction.

– Investing a lot to develop cutting edge skills & resources

– Low cost deployment. This is a unique one because an employee in Eastern Europe generally costs more than in India. But EPAM’s high quality hiring allows it to hire in Europe and still finish up projects at much lower final cost compared to its peers who have higher presence in IT hubs like India.

In short, EPAM is able to do more with less resources, create a lot future value & present savings for customers while keeping its employees motivated and satisfied. All this while maintaining a long term ~20% ROIC with a healthy balance sheet. Something to keep an eye on!

Note : The goal of this post was to discuss EPAM’s business model, qualitative aspects and future potential. I have intentionally left detailed financial numbers like cash flow from operations, balance sheet strength, valuation models, etc from this article because this is not a buy or sell recommendation.

Also if you liked my article and want to read about another unusual company with great potential, click here : LEATT

Comments