We often get mixed up between saving more money so that we can do more things and doing less things so that we can save more money. And an idealist would tell you that a balance between the two is the right place to be.

But what tells you that you are in that balanced zone? And if you are not, how to get into the balanced zone?

Well to understand that, we need to first understand the purpose of making, saving and investing money. It helps with two things – for day-to-day survival and to meet life goals. And these life goals can range from buying a car in a few years to having enough for retirement. So if its goals that we wish to fulfill then why not optimize our investments to meet these goals.

This goal based investment allocation has several benefits:

- It will tell you how much you regularly need to invest for each life goal.

- It will guide you on what type of assets to invest in depending on associated goals.

- It will also tell you if your current spending is too high and will cause you to miss out on future goals.

- It will also help you manage liquidity, when you need it, efficiently.

- It will also show you if you have enough to add more materialistic goals in your life.

I believe the concepts are best understood through an example. So while I go through each step, I will use this framework to plan goal based investment allocation for Frugal Family (our imaginary & smart friends who want to fulfill their dreams). Let’s begin…..

Step 1: Investment Summary (Personal Balance Sheet)

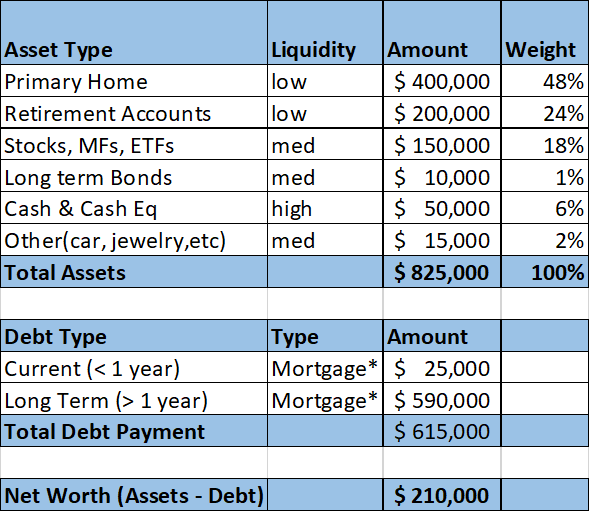

– Create a comprehensive list of your investment that capture type of asset and amount, liquidity attribute and percentage allocated in each asset.

– Then capture debt payments (if any). Divide them into “current” (payable in less than a year) and long term.

– And finally, calculate your net worth.

Investment Summary of Frugal Family:

Step 2: Net Income cash flow (Personal Cash Flow Statement)

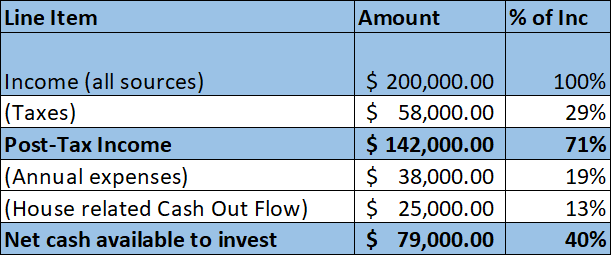

Create a cashflow statement. Start with compiling ALL sources of incoming cash including compensation, business income, passive income from rents and dividends. Create three outflow categories – Taxes, Annual living expenses and House related expenses (mortgage, interest, repair cost, property taxes – all outflows related to your primary residence). And then calculate the percentage of each outflow category w.r.t total income.

Cash Flow Statement of Frugal Family:

Step 3: Calculate money required to fulfill associated goal.

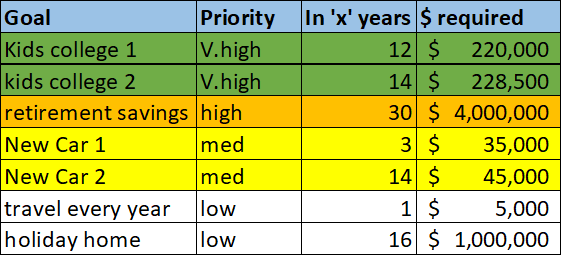

Write down your life goals, number of years left for each goal, priority of each goal (Very High, High, Medium, low) and calculate how much money you would need to meet each goal.

Spend a decent amount of time thinking about all the important milestones that you want to reach and how much it would cost. To calculate the cost, find out current cost of that goal, annual historical inflation and use that data to come up with how much it would cost in the future.

Let’s say the Frugal Family wants to calculate how much it would cost to send their child to college. Here’s how they would calculate it:

Goal: Fund younger daughter’s college expenses.

Priority: High

In how many years: 14

Required money after 14 years = [Current cost * (1 + annual category inflation)^number of years ] + 10% buffer (in case your assumptions are wrong) = (120k * (1 + 4%)^14) + 10% buffer = $228.5K

Once you have listed down all your goals and calculated their associated cost, list down all the goals in a table in order of priority(highest to lowest) and number of years left (lowest to highest).

Goal Sheet for Frugal Family:

Step 4: Funding Goals

This is the most important step of this framework as it helps us calculate required investment. And it is divided into 2 sub-steps:

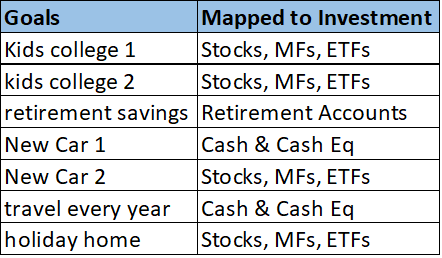

4.1. Map goals to Investment Asset:

In this step we map each goal to an investment asset. The idea here is to match the goal to an investment asset in which you will invest the money to achieve that goal. Use priority and longevity (number of years to the goal) to determine what investment asset the goal should be matched to. For instance, if you have an important expense upcoming in 2-3 years, it is better to save that money in a liquid and safe fund.

My advice for mapping goals to investment asset:

Goals to be reached in less than 3 years -> Cash & Cash Equivalent.

Goals to be reached between 3 and number of years left to retire -> Socks, Mutual Funds, ETFs (Long term assets)

Post retirement goals -> 401k, IRAs, etc.

Map Sheet for Frugal Family:

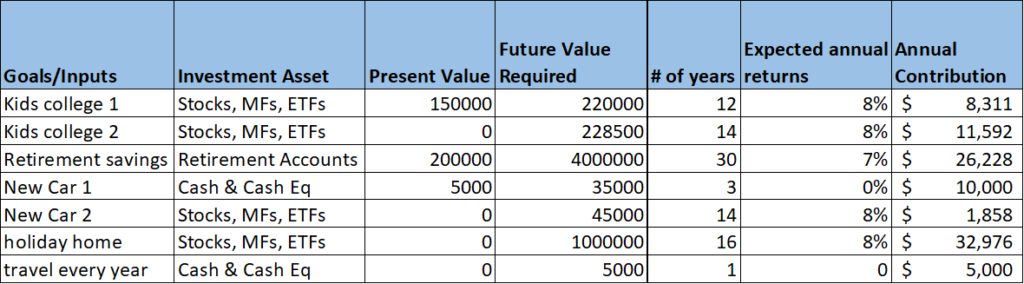

4.2. Calculate Annual contribution needed for each goal.

Start with the high priority goals and move down to the list. To perform this step you will need to calculate “annual contribution required” using the Present – Value Calculator . To perform this step, you will need start value, end value required, number of years and expected returns. For expected annual return you can use long term index returns as a proxy.

For the highest priority goal in each category (0-3 years, 3- retirement, post-retirement), use the mapped investment as the starting value. And use zero as the starting value for other goals.

This step throws out how much capital you need to invest annually into each asset to meet your life goals.

Annual Contribution table for Frugal Family:

Step 5: Test viability of each goal vs investment allocation

Add total contribution required (from step 3) to meet all goals and compare it against your net cash available to invest (from step 2).

If sum of total contribution required is less than net cash available to invest, you are good to go. Start investing the required annual contribution for each goal to its associated Asset type.

However, if the total contribution required is more than net cash available to invest, then you don’t have enough capital to meet your goals. In this case, you have the following options

- Remove or modify goals so that your total contribution required reduces. Start with compromising on low priority goals.

- Push out some near by goals by a few years till your total contribution required becomes less than cash available to invest.

- Increase cash available to invest by reducing your annual expenses. This might require lifestyle compromises.

- Increase your incoming cash. This could be through a side gig or by getting a raise on your current job or by increasing your business income, depending on your situation.

Total contribution required by Frugal Family to meet their goals: $95,965

Total cash available to invest: $79,000

Clearly, Frugal Family doesn’t have enough cash available to fulfill all their goals. Therefore, after reviewing their priorities, they decide to remove their “holiday home” goal until they find another source of income.

Total Contribution required (after removing “holiday home” goal) = $62,989

Step 6: Update these tables every year & make associated investment changes.

As time passes your situation is bound to change and so will your desires & goals. Therefore, perform this exercise at least once a year and update your table as your earnings, expenses or goals change.

Final Comments

This is a very powerful framework, if you use it to your advantage. This framework doesn’t just tell you the possibility of meeting goals or not, but also tells you on how to manage your portfolio. But the quality of your calculations, especially if those calculations require assumptions about the future, are as good as the quality of your assumptions. So be conservative with your assumptions and add a buffer amount to each goal.

Happy Investing!!

Note: The example above is quite generalized and an individuals financial situation can be more complex than the example I shared above. If you have any questions or need help with the process, feel free to reach out to me. You can comment here or send an email on compoundwithkevin@gmail.com

If you like what you read, consider subscribing to my newsletter: Click Here

Other interesting blogs related to investing:

Buying a dollar for 50 cents : Talks about importance of buying a stock at a discount and a case study that provided a 151% return in 1.5 years.

Bought the right company at the wrong price : One of most important mistakes investors make and don’t even realize. You might be making it too!

This is really helpful to understand. Thanks for sharing.