Are you one of “I will not sell this stock until it comes back to my buying price” investor? One who doesn’t like to book a loss on any of their investments.

You are not alone. You are of the kind who wants to win every bet they make, win every battle they fight. And in this quest they hold on-to the positions until they turn green, even if it takes years. This is a very common mindset among all investors.

This results in keeping bad companies in the portfolio for long, missing out on better opportunities or both. Eventually reducing the total portfolio returns in the long run. In fact, this is one of the main factors that differentiates great investors like Peter Lynch, and Warren Buffet from an average investor. Even though media mainly highlights the great stock picks of these legendary investors, their great performance is also due to their ability of cut mistakes quickly, allowing them to invest more in better businesses.

Therefore, in order to become a better investor, we need to develop the trait these great investors have. In this post, we will learn the reason behind this mindset of wanting to win all the bets we make, repercussions of having this mindset (with an example), how do we solve it (or at least get better with time), and an important WARNING. It will help you to “Let your winners grow, and cut your losses quickly”. Let’s get to it:

WHY DO WE HAVE THIS MINDSET?

My guess is we develop this mindset early on, and it comes from our education system. In school, a student cannot progress to another grade even if he gets A+ in all other courses but fails in just one. He has to get a passing grade in each course to move to next grade, and eventually graduate. Because of such conditioning, we develop higher sensitivity towards pain of failure than towards happiness of passing.

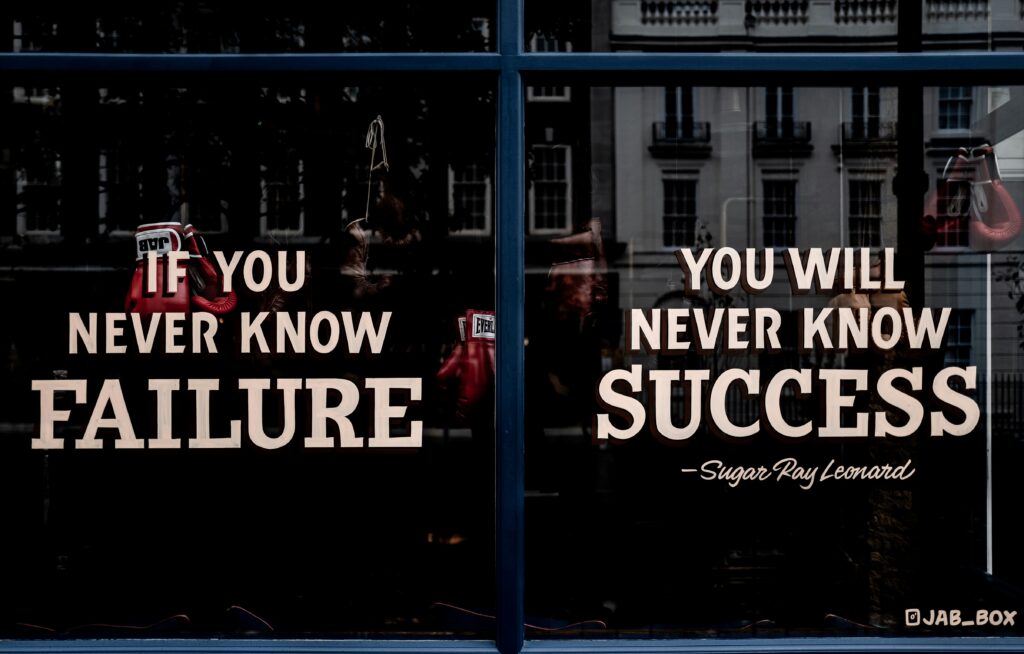

Unfortunately, this mindset doesn’t leave us after we leave school. And most of us carry it with us in investing as well. Therefore, its not surprising that almost of all of us don’t feel comfortable selling an investment that books a loss.

We fail to understand that the game of investing has different rules than the game of school. In investing, only one thing matters – your portfolio returns. It doesn’t matter if you get a 10x returns by making gains on each investment or by making losses in many. In fact, you will be much better off if you made 10x returns even with many loss making investments than making a 2x return but being profitable in all investments.

REPERCUSSIONS OF HAVING THIS MINDSET?

There are 2 main repercussions of having this mindset:

- Holding onto losers forever: This is an obvious one. Holding on these losers just because they are losers (not because you expect the company to do better), and waiting for them to turn green will reduce our overall portfolio performance.

- Not able to add to potential winners: This is the one that most of us miss. We don’t realize that there is an opportunity cost of holding onto our losing investments. Even if a great new opportunity appears at our door step, we don’t consider the option to sell the losers, and invest more in this new, better opportunity.

Personal Example:

Back in 2022, I had a concentrated investment in a company in which I was at 20% loss. I knew that the fundamental and future prospects of this company had degraded since the time I had invested in it. But I held on to it with the hope for it to come back to my buying price, and then sell it.

At the same time, META, a company that I had followed closely over the years was priced at ~$240B market cap. At the time it had an intrinsic value of at least $800B (according to my research).However, because of my pet-peeve of not able to sell anything for a loss, I failed to sell the investment at 20% loss, and invest the amount in Meta.

And guess where do we stand in 2024? Meta is up more than 5x, and the loss making investment has recovered a bit, and it is 5% above my buying price. Therefore, even though my portfolio looks all green today, overall, I missed the opportunity to double my net-worth in 2 years, even after doing all the required research, and work. (Click here if you want to learn more about my META investment)

HOW DO WE SOLVE THIS PROBLEM? (or at least incrementally improve)

In Finance, as in life, it is harder to solve a behavioral trait than a mathematical one. Therefore, I don’t have a formulaic solution to this problem. However, I can still give you some methodical ways that will help you question your decisions regularly, and detect if you are making the mistake of holding on to your losers, just because they are losers.

CHECKLIST SOLUTION: Often, to deal with behavioral biases like these, I try to develop a checklist that helps me detect these biases, and question my decisions. Here is the 2 step checklist I use for the current problem at hand:

- Go through all the stock holdings in my portfolio (Usually, these are less than 7) and Check if investment thesis still holds for each?

- If the story of the company has changed, and my investment thesis is out of the window, why do I still hold it?

If you decide to follow this simple checklist, I would suggest you to write down the answers on a paper, instead of thinking it through. Writing down will help you question yourself deeper, and help you reach a reasonable conclusion. I do this every 2-3 months or whenever I find a new opportunity to invest.

FRIEND/MENTOR: This one is very effective. If you have a friend or a mentor with whom you are comfortable to share your thoughts, and investment picks, try this one out. Present your investment thesis on each of your holdings, especially the loss making ones, and ask your friend to play Devil’s advocate. This will help you find loose ends, and make you question your decisions harder if your investment thesis still holds.

Overall, the combination of these two techniques have improved my thinking process. It has helped me identify if my aversion to loss is the only reason for holding onto a bad business. I am sure it will help you too.

WARNING & FINAL THOUGHTS

Even though it might be obvious to all you smart readers, I want to emphasize that by no means, I am trying to say that one should always sell all of their loss making investments. The purpose of this post is to simply point out the behavioral bias that most of the investors have, especially the new ones, and the effect it can have on our portfolio returns. Also, behavioral biases are tough to resolve as it required unlearning something that we have developed over many years. Only through being aware, regular self-questioning, and analyzing past behavior can one improve gradually.

If you liked this post and want to learn more about unique businesses, consider Subscribing

And if you want to become better at investing, learn other frameworks: Click Here

Comments