Return on Equity (ROE) and earnings growth are the main drivers of value. While retail investors focus on earnings growth, understanding and analyzing a company’s ROE is equally important. ROE not only indicates how much money a company makes on its invested equity capital but also reflects the quality of the business and management.

To find compelling long-term investment opportunities, understanding the drivers of ROE and how to analyze them is crucial. By the end of this article, you will learn:

– What is Return on Equity?

– How it adds or reduces value of the company?

– What factors drive the ROE of the company? How to analyze these factors?

Let’s get to it.

What is Return on Equity?

Return on Equity simply means the returns does the owners of the company make on their invested capital.

Example: If the owner of a lemonade stall has invested $100 of his own capital and made a $7 profit at the end of the year, the Return on Equity of that business is 7/100, 7%.

How it adds to or reduces value of the business?

While most of us know the meaning of Return on Equity, this is the part that many investors don’t understand. And it results in bad investments or poorly ran business. Therefore, take some time to think about it after you read through this section.

For a business to add value, it is important that the ROE is higher than the Cost of the Capital. While financial academics throw at us a complex definition and formula to calculate it, there is a simple way to think about it:

How much would the owner make if he decided not to do the business and use the capital to invest in a safe investment?

– If the owner makes more return than he would make in a safe investment, the ROE is adding value.

– But if the owner makes less return than he would make in a safe investment, ROE if reducing value. (And if it impossible to make higher returns than in a safe investment, the rational thing would be to shut down the business)

Continuing with our Example:

In our above example, the ROE of the lemonade business was 7%. If the 30 year long term Govt. bond pays 8%, the owner would be better off if he decides to invest in bond rather than running the lemonade business.

However, if the owner has a strategy to improve the business economics, and it is possible to make greater than 8% of ROE, the business will add value, and the owner should continue running the business.

As an investor, it is important to find out whether the company’s ROE is greater than its cost of capital, and whether the ROE will improve or degrade in the future. And to find the answer to whether the ROE will improve or degrade, it is important to understand the factors that drive the ROE.

What factors drive the ROE of the company? How to analyze these factors?

There are two major factors that drive the ROE of the company:

1. External : Economics and attractiveness of the Industry the company is in.

2. Internal: Impact and effectiveness of company’s strategy.

1. External Factor: Economics and attractiveness of the Industry the company is in.

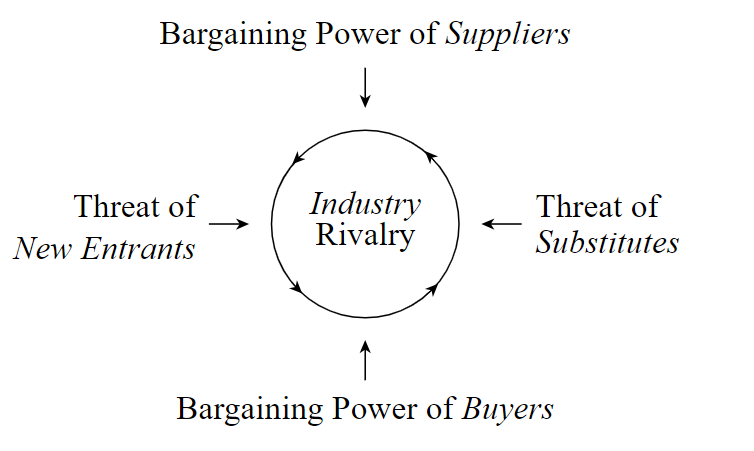

The ROE of the company highly depends on the industry and the economic factors that it operates in. Certain industries have better economic conditions than others, and therefore enjoy better Return on Equity than other industries. Porter’s 5 forces model is a perfect framework to analyze the attractiveness of the industry. Stronger the force, lesser would be the industry’s attractiveness and therefore the average ROE of the companies in that industry.

Here are the 5 forces :

1. Competition among the companies in the industry:

If it is a highly competitive industry, chances are that there would price competition that can reduce the profitability of the company. Example – grocery stores are forced to keep the prices as low as possible due to high competition.

2. Bargaining power of suppliers:

If the supplier to the company yield higher bargaining power, the cost of supplies goes up, and therefore reduces the margin and therefore ROE. Example – TSMC charges high prices to Nvdia and Apple for manufacturing their chips because Nvdia, and Apple doesn’t have any alternative supplier.

3. Bargaining power of the buyer:

If the buyer has power to negotiate lower prices, it will put pressure on the selling price and therefore reduce margins, and ROE of the company. Example: Giant discount stores like Walmart, and Costco buy huge quantities from the merchants, and therefore negotiates too hard to keep the buying price low. This results in lower margin and ROE for the merchants.

4. Threat of Substitute:

If the customer has the option to substitute the product with some product from other industry, there will be less pricing power, and therefore lower industry ROE. Example: Customers have an option to skip going to the cinemas for watching movies and substitute it by watching them on OTT platforms if movie tickets are too high. This has kept the movie ticket prices low and thereby reduced the industry’s ROE.

5. Threat of New Entrants:

If it is easy to start the business in the industry, there is a high risk of new businesses entering the industry, and thereby increasing the competition. This will result in pricing pressure, and therefore lower ROE. Example: It is relatively easier to start a restaurant business than a SaaS company. Therefore ROEs in the restaurant industry is generally lower than ROEs in the SaaS industry.

Use this framework to analyze the attractiveness of the industry of the company you are considering to invest in. By going through this exercise, you can find whether the average ROE of the companies in this industry is greater than the cost of the capital or not.

This will help you filter out companies if they operate in the industry where there is long term value destruction, and therefore less probability of making good returns on your investment. However, if you find out that the industry dynamics are good, and the companies in the industry enjoy good ROE, you should move on analyzing the internal factor that affects the ROE.

2. Internal: Impact and effectiveness of company’s strategy.

Even within an industry, the ROE among the companies vary widely. This is due to company’s own strategy, and operational efficiency. Generally, companies with better strategy and execution enjoy better ROEs than their competitors. Depending upon their industry, company’s adapt one or combination of the following strategy:

– Differentiation : Company tries to differentiate itself that its customers by providing different value proposition. It could be better service, better design, etc. that is not easily replicable by their competitors. This helps attract more customers, increases customer loyalty, and eventually increase ROE.

– Low Cost: In certain industries, companies can create a competitive advantage by becoming a low cost providers, thereby getting more customers, and market share. In the long term, these companies can enjoy economy of sales, and thereby improve ROE.

While researching about the company, you can find out whether the company’s strategy is different than its competitors. Generally if the strategy is different, effective, and well executed, you will find better long term ROE number than their competitors.

The Bottom Line

Understanding ROE’s importance and nuances makes you a better investor. Analyzing ROE helps evaluate:

- Industry attractiveness

- Business strategy

- Competitive advantages

- Management effectiveness

By using this framework, you’ll develop a deeper understanding of industries and improve your ability to filter out bad businesses.

BTW, if you liked what you read, consider subscribing to my newsletter.

Further Reading: Good Business, Bad Business: How Payment Terms reveal the Truth

One thought on “What are the drivers of Return on Equity and How to analyze them?”